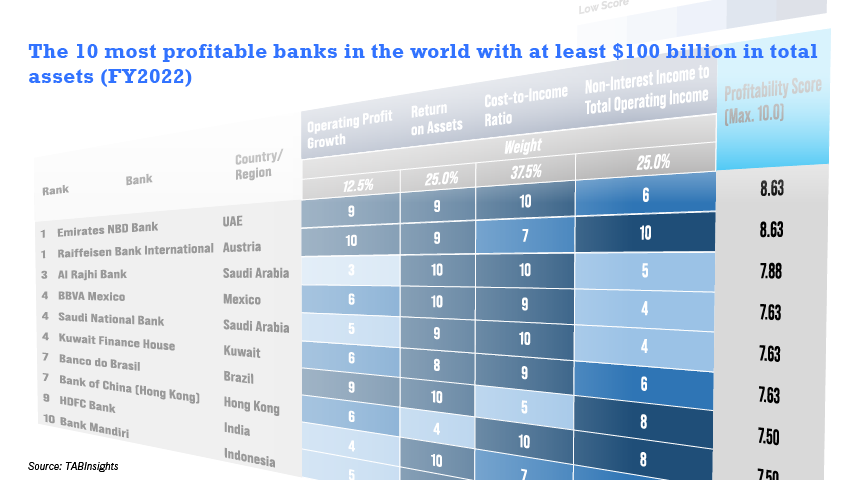

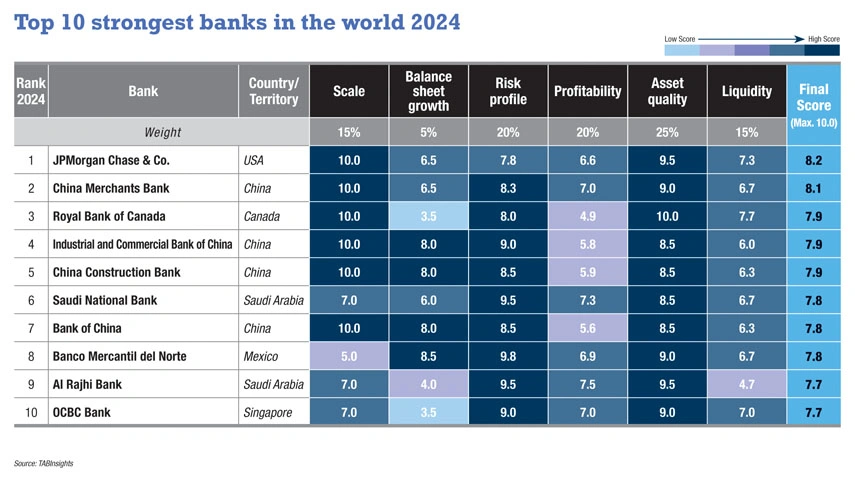

North America and Asia Pacific banks maintain overall balance sheet strength over those in other regions, with the Middle East showing some improvements. Profitability among all 1000 banks improved, driven by higher interest rates, while asset quality indicators stayed stable.

.jpg)

.webp)